The rivalry between Vietnam and Bangladesh assumed a new dimension recently following publication of a World Trade Organisation (WTO) report.

Closest competitors as they are in the realm of garment manufacturing and exports, in the lead up to the WTO findings, Vietnam had surpassed Bangladesh in 2020 to become the second largest readymade garment exporter after China, shipping apparels worth US $ 29 billion world over even if Bangladesh rallied from behind to surpass Vietnam within a year.

Apparel exports, the lifeline to Bangladesh’s economy and foreign earning, posted a robust growth of 30.36 per cent, the highest ever in the calendar year 2021 to earn US $ 35.81 billion (earning from apparel exports in 2020 was US $ 27.47 billion).

Vietnam too managed to register 9.89 per cent growth in 2021, but could earn only US $ 32.75 billion in apparel exports compared to Bangladesh’s US $ 35.81 billion.

In 2020, Vietnam had earned US $ 29.80 billion from apparel exports.

“It was a temporary change in ranking in the global apparel export market as COVID-19 hit our production badly, which negatively impacted exports,” claimed Abdus Salam Murshedy, Managing Director of Envoy Textile who maintained with the outbreak of pandemic in March 2020, Government-enforced lockdown resulted in factories’ production taking a considerable hit.

“As a result, our exports declined sharply. Though, later it recovered but could not reach the pre-pandemic level immediately,” explained Murshedy who is also a former President of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), adding, “On the other hand, Vietnam factories were functional. Vietnam thus earned more. But in 2021, we were flooded with work orders and reclaimed our position.”

“Coronavirus did put a spanner in our production too as pandemic-induced regulations and restrictions made things difficult for the Vietnam garment makers before things started improving slowly,” claimed Pawan Gupta, Country Manager of Cortex Textiles, Vietnam.

Cortex Textiles is a Vietnam-based manufacturer of contemporary men’s and women’s casual woven tops, casual bottoms, soft shell jackets and performancewear, and has its manufacturing unit in the Lien Chieu Industrial Park in Da Nang City.

If Bangladesh had to bear the pandemic fallouts in 2020, in 2021, it was Vietnam’s turn to deal with its disruptions, especially towards the end of the year.

However, even if Bangladesh managed to reclaim its position as the second biggest apparel exporter globally, the WTO competitiveness report, prepared after surveying respondents including exporters and brands and retailers while also taking into consideration data contributed by several UN agencies including the United Nations Conference on Trade and Development (UNCTAD), underlined Dhaka has a lot of catching up to do with Hanoi in terms of overall competitiveness.

The report took into account several aspects like product quality, lead time, sustainability, workers’ efficiency, innovation, flexibility of order quantity, financial strength, political stability, etc., before coming up with its report.

Bangladesh lags behind in sustainability quotient

In sustainability index, Bangladesh managed to score 2 compared to Vietnam’s 3.5 even as respondent’s average rating of 1 denotes very low performance, while 5 means much higher than the average.

Considering how sustainability has emerged to be a major determinant in enabling business growth and profitability, one might wonder how Bangladesh, which boasts of the highest number of green factories globally, trailed Vietnam by one and half points even if many within the industry questioned the relevance of assessing the industry on the aspect of sustainability.

“This is a marketing concept that looks good, sounds good, but…,” underlined Sylvain T Croci, a garment and textile consultant based out of Ho Chi Minh City in Vietnam, who feels it is not fair to grade any country (between Bangladesh, Vietnam and China) better than the other in terms of sustainability even as he agreed Vietnam has an advantage over Bangladesh when it comes to the all-important aspect of speed to market.

“The report mentions environmental compliance-related risks as a downside for sourcing from Bangladesh, while the industry has made a huge stride to transform workplace safety, workers’ well-being and environmental sustainability. The rating seems to be inappropriate,” said Faruque Hassan, the President of the apex garment makers’ body of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), on his part.

Factors affecting lead time…

“Lead time is very crucial in the current competitive market…,” observed Managing Director of Plummy Fashions Limited, Fazlul Hoque, who highlighted in no uncertain terms the huge efforts Bangladesh need to put in, in terms of port and customs management even as according to the WTO report, Vietnam fared much better than Bangladesh in sourcing raw materials and could release import consignment (from the ports) within 24 hours.

In contrast, Bangladesh takes 48 hours to one month to release raw materials from the ports here, claimed industry insiders in Bangladesh.

“There are lots of issues with the Chittagong Port; many a time, ships have to wait at the outer anchorage for a long time in the absence of enough berthing space; plus there are inordinate delays on release of consignments. Everyone knows we work under tight deadlines, and such delays adversely impact the business,”explained Fazlul even as another garment maker observed: “Transportations from and to Chittagong Port eat up a major portion of our delivery deadline…Vietnam certainly is well ahead of us in overall logistic support.”

Lack of a deep sea port turned out to be a major worry for the Bangladesh garment exporters who have to send their produce through feeder vessels to transshipment ports from where goods are transferred to mother vessels for shipment to Europe and USA.

Vietnam in contrast can directly ship to the buyers from its seaports.

“There remains a risk of missing the mother vessel even if the feeder vessels are late for one day to reach the transshipment port. In many cases, ships leave the Chittagong Port without taking the goods to get the schedule of the mother vessel. This makes it uncertain to send the product to the customers at the stipulated time,” claimed BGMEA Vice-President Rakibul Alam Chowdhury.

The introduction of a direct waterborne service between Bangladesh and Italy recently has, however, set to make shipping apparels between Bangladesh and Europe, which incidentally accounts for 82 per cent of Bangladesh’s total exports, cheaper, faster and smoother even as construction work of the Deep Sea Port in Matarbari in Cox’s Bazar is on in full swing.

“After lifting of the pandemic-induced lockdown last year, the work is continuing without any break now and is likely to end within 2025,” assured a concerned port official while Member of Chittagong Port Authority (CPA) and Project Director of the Deep Sea Port project Mohammed Zafar Alam underlined after completion of the project, Bangladesh’s export and import will get a major facelift.

“As a whole, the maritime connectivity of Bangladesh will be increased remarkably,” he claimed, adding, “The Deep Sea Port will enhance manifold the total container and cargo-handling capacities of the Chittagong Sea Port as larger ocean-going ships with deeper draft will be moored at Matarbari.”

Till then, Bangladesh apparel makers, it seems, are in for some trying times.

Efficiency and innovation worries…

Workers’ efficiency and product development are two other aspects wherein Bangladesh is lagging behind Vietnam, which scored 4 in terms of respondents’ rating in both these aspects compared to Bangladesh’s 3 even if many garment makers in Bangladesh agree Vietnamese workers are 10 per cent to 15 per cent more efficient than those in Bangladesh.

Sylvain is, however, not ready to accept this!

“…Vietnamese and Bangladesh workers are equally good, competent and reliable,” he said while adding higher education levels give an edge to Vietnamese workers for sure in terms of picking up complex things faster.

But, on the other hand, Bangladesh boasts of abundant manpower.

Nevertheless, to increase the efficiency level of the garment workers, BGMEA President had called upon all its member factories to arrange in-house training programmes, to strengthen the future of the RMG industry.

“I believe a dedicated initiative by each of our factories to train workers will actually complement the whole industry,” wrote the BGMEA chair to the members, adding workplace-based training is more effective than classroom training.

To help support factories’ efforts, the garment makers’ body also runs many centres for workers’ training across the country, while also collaborating actively with other stakeholders and development partners in skill development programmes including the establishment of the Centre for Innovation, Efficiency and OSH, which is expected to give a boost to workers’ training.

Bangladesh industry is comfortable in basic items such as T-shirts, denim and trousers, while Vietnam is edging past due to its value-added product manufacturing that can be deemed as complex when trying to get them integrated into mass production lines, underlined a Country Manager of a European retail giant in Bangladesh while Senior Research Fellow at the Bangladesh Institute of Development Studies (BIDS) Kazi Iqbal said Bangladesh does not only have factories adding value to products, they are also claiming better price points from brands and retailers.

“But their numbers along with the output volume are low…,” Kazi conceded.

Product differentiation advantage for both

Even if Bangladesh and Vietnam are considered competitors, their forte in different product categories, differentiates the two. If Bangladesh is more into basic products produced in volumes, Vietnam excels in high-end offerings!

“While Vietnam is seen as a sourcing hub for value-added products, and is strong in synthetics too, Bangladesh is considered a destination for low-cost manufacturing…,” said Rahul Varma, Director-Sourcing & Quality Assurance Global Hansoll, based in Ho Chi Minh City while another Bangladesh-based garment maker stated: “Vietnam mainly exports formalwear, jackets, critical workwear and some casualwear, which are costly in terms of quality and value… Bangladesh exports more low-priced casualwear and some formalwear in woven.”

As expected both the countries leverage their strengths in different market segments even if the WTO study carried out is principally based on basic parameters, said the industry insiders, who felt product differentiation is what is going shape their future.

Fazlee Shamim Ehsan, the BKMEA Vice-President, surely does not agree with all the indicators showing Bangladesh apparel behind Vietnam.

“None is supposed to be ahead of us in terms of flexibility of order quantity. We accept orders so flexibly that buyers can take several thousand pieces to only a few hundred pieces from us,” he claimed, adding, “We manufacture products as buyers want. Since Bangladesh is capable of satisfying the brands with the quality, the country is getting increasing work orders.”

The WTO report based on the respondent’s feedback attributed Bangladesh 3 points in terms of flexibility of order quantity even as Vietnam edged past Bangladesh here too by a point.

Though the BKMEA Vice-President defended the quality of Made-in-Bangladesh products, he agreed the country has to improve in terms of value addition.

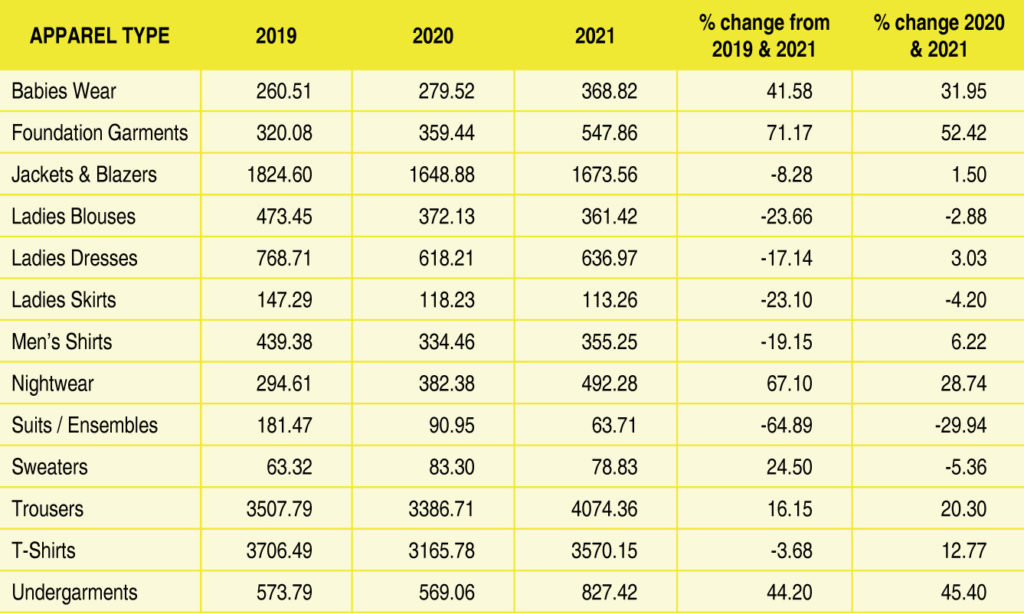

Bangladesh – Item-wise % change in apparel exports to the US (Value in US mn $)

Vietnam – Item-wise % change in apparel exports to the US (Value in US mn $)

Price and tariff play in Bangladesh’s favour!

Trailing behind Vietnam in many other indices, Bangladesh scored over the closest competitor in terms of both price and tariff advantage, thanks to duty-free access to key global markets and availability of cheap labour.

In price, Bangladesh scored 4.5 points compared to Vietnam’s 4, while in tariff advantage it managed to just inch ahead of Vietnam scoring 3.5 points compared to Vietnam’s 3.

Bangladesh still enjoys a variety of trade benefits from EU, Canada and Asia Pacific, which attracts brands to source from there, opined Pawan Gupta even as noted economist Dr.Abdur Razzaque gave an edge to Vietnam on account of the various FTAs that it had signed lately while also considering the volume of FDI pouring into Vietnam.

Effective from 10th December 2001, Vietnam has a bilateral trade agreement with USA, which is said to be one of the most comprehensive trade pacts Vietnam has ever signed and covers a wide array of aspects including trade in goods, protection of intellectual property rights, trade in services, investment protection, business facilitation and transparency.

Signed on 30th June 2019 and gone into effect on 14th August 2020, there is also the EU–Vietnam Free Trade Agreement, which further gives a leg-up to Vietnam in the all important European market and more so at a time when Bangladesh is set to join the league of developing nations that would shorn it of the duty advantages that it currently enjoys as a Least Developed Country (LDC).

“Many buyers consider duty-free status as a critical determinant of sourcing decisions. Although entire sourcing will certainly not be concentrated in Vietnam, but with the loss of tariff advantages, Bangladesh will come under intense competitive pressure…,” noted renowned economist Dr.Abdur Razzaque, while adding Bangladesh is likely to lose preferential treatment in the EU apparel market, Vietnam will be able to secure duty-free access in that market because of the FTA.

Even though the WTO report suggests Bangladesh may concede a loss of US $ 5.37 billion due to the impact of LDC graduation on export, if the Country Manager of Cortex Textiles is to be believed, trade pacts are mere ‘symbolic’ and cannot prove to be of much help for Vietnam.

“…the conditions that they come with, Vietnam cannot match for next 5-10 years,” claimed Pawan even as Fazlul Hoque on his part maintained, “Bangladesh is working on the issues mentioned in the report, but it needs to be speeded up. We need to focus on FTAs and PTAs.”

Given the competency and manufacturing prowess, Bangladesh garment makers are but confident preferential treatment or not, there’s no reason to lose sleep in terms of apparel export performance!

“Despite not being covered by the GSP facility, we are still ahead of China and Vietnam in terms of export growths in the US market,” underlined a garment exporter and rightly so!

In January-December ’21, Bangladesh has outwitted China, Vietnam and Indonesia in terms of growth in apparel exports to the United States.

As per an analysis done by Team Apparel Resources (AR) using official US custom data, Bangladesh, which now ranks third in RMG exports to the US, fetched US $ 7.15 billion from USA in 2021, up by around 36.70 per cent from the receipts over the same period in 2020, even if China’s exports to the US market amounted to US $ 19.61 billion with a 29.40 per cent growth, followed by Vietnam at 14.33 per cent.

No matter the comparison in terms of overall competitiveness, industry insiders feel the friendly competition between the two countries will continue and is needed too, to keep the growth momentum going.

“Both Bangladesh and Vietnam will continue to grow no matter what…,” wound up Pawan on a positive note but not before adding it is even-stevens at the end of the day as Vietnam may score over Bangladesh in some aspects, while Bangladesh will use its position of strength in other areas, especially keeping in mind the product differentiation aspect, which will ultimately help draw the much-needed parity and balance things out in long run.