The conflict between brick & mortar and online retail is just getting fiercer with companies on either side trying to prove that the consumer loves them more. But the reality that some have missed on is that the digital space is not eating up the physical stores, but in fact the synergy between the two is the real thrust of success. The growing impact of omnichannel retail cannot be ignored by any player along the retail chain, from the manufacturers onwards. Put in simple words, an omnichannel strategy in retail is the biggest trend to hit retail in a long time. Admittedly, the movement is not new, but the forcefulness of the impact is peaking in 2018.

Retail analyst defines an omnichannel retail strategy, as an approach to sales and marketing that provides customers with a fully-integrated shopping experience by uniting user experiences from brick-and-mortar to mobile-browsing and everything inbetween. This is, however, easier said than done. Yet, many retailers have found success that is eluding many others. As consumers purchase more and more goods online, traditional retailers and online retailers alike are struggling with the integration of online and brick-and-mortar commerce. Most retailers have accepted the importance of a seamless omnichannel experience that marries online and in-store purchases, exchanges and returns, making significant changes in their marketing, advertising and social media efforts, as well as their accounting and inventory systems, to allow for this integration.

While there are some products that are popularly sold on the online platform, clothing/fashion is still about feel, fit and experience. Consumers may eventually buy online but they enjoy going to the stores and checking out the designs and fitting, personally. In a recent research conducted by Harvard Business Review involving 46,000 customers of a single retailer leveraging an omnichannel strategy, the researchers who ran the study segmented the customers based on – whether they were online-only (7 per cent), in-store only (20 per cent), or used multiple channels (73 per cent). The omnichannel customers spent an average of 4 per cent more in store and 10 per cent more online in the 14-month study period versus the customers who purchased through a single channel. And every additional channel used resulted in a higher amount of money spent; customers who used four or more channels spent 9 per cent more on average versus people who used just one channel.

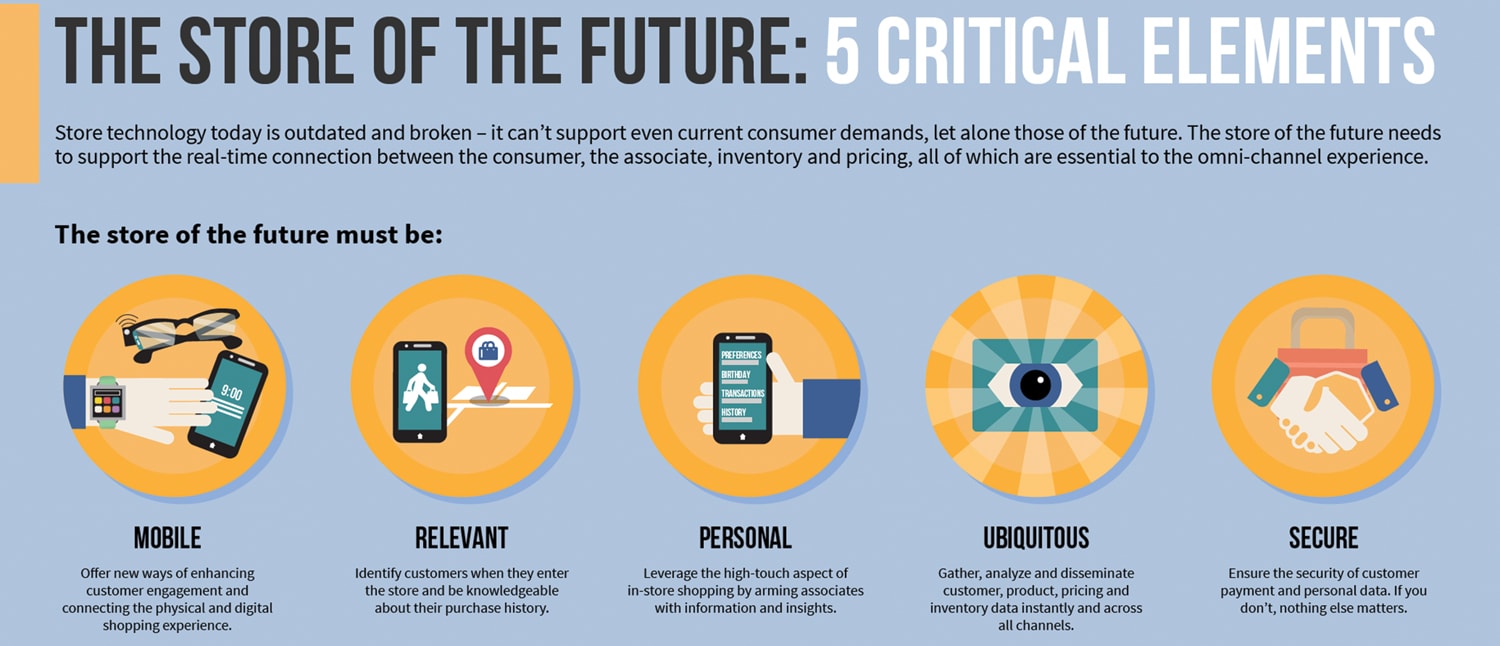

The message is loud and clear – if retailers want to challenge the onslaught of online giants like Amazon that are eating away market share, the tractional retailers have to have an omnichannel strategy in place, to provide the customer an edge that Amazon and the likes cannot duplicate easily, engaging customers in a way that online retailers cannot, by allowing customers the chance to try a product before they buy it. It’s in the perfect blend of online and offline omnichannel strategy that retailers can fix their revenue problem – but only if, they have the right technology supporting their goals.

To understand the criticality behind an omnichannel retail strategy, it is important to analyse the growth in online sales. Among a group of 11 of the largest traditional US-based brick and mortar retailers (Bed, Bath & Beyond; Best Buy; Dick’s Sporting Goods; The Home Depot; JCPenney; Kohl’s; Lowe’s; Macy’s; Nordstrom; Target; Walmart), nine reported online sales growth that outpaced total ecommerce; the other two reported online sales grew by double digits. Four retailers (Walmart; Lowe’s; Target; Best Buy) even grew online sales at a more rapid pace than Amazon, which was up 27 per cent in the second quarter of 2017.

It is obvious that online growth is strong, but surprisingly, offline retail is not all carnage. Among the retailers named above, only four of them, who happen to be in the general merchandise or home category, experienced a decline in samestore- sales in the second quarter. Although, declining same-store-sales is bad news, shifting investment into ecommerce and closing stores to help free up capital to do so, makes good business sense. There is a focus on aligning physical stores with the ecommerce channel, investing in private brands, and aggressively expanding product assortment.

Customers are getting very demanding; they expect to see the right offer at the right time, irrespective of the time and occasion.

This demanding customer can be fully satisfied only by omnichannel retailing, where the experience is seamless between a website and physical store. For retailers who have made the move, the investment is paying dividend today with significant unit volume now being fulfilled by stores and/or picked up in stores by consumers. In its second quarter 2017 earnings call, Target said 40 per cent of its online unit volume was fulfilled from stores. By the end of 2017, the company expects to be fulfilling orders from 1,400 of its 1,800 US stores. The picture is similar at Kohl’s, where 31 per cent of online orders were either picked up in store or shipped from store. Impressive as that is, the prize for the “king of omnichannel” might go to Best Buy, where approximately 50 per cent of unit volume was picked up in store or shipped from store in the second quarter of 2017.

Retailers like Macy’s and The Children’s Place are also hot on omnichannel retail. Macy’s is continuing to see serious growth in the area of “buy online, pick up in store” (BOPUS) and the retailer firmly believes that “physical stores are not going away and customers will always want the option of coming into the store to try on jeans instead of buying three different sizes online. The Children’s Place is also making a “big move towards digital and employing a lot of the omnichannel use cases like BOPUS and ‘Save the Sale’, which requires store associates to have the ability to access realtime inventory across the network of stores. This inventory access enables store associates to keep customers from walking away from a purchase by finding their desired item online or at another store location with ease.